Payroll management is a critical business function that demands specialized knowledge and attention. Payroll providers offer businesses a solution to navigate the complexities of tax regulations, employee compensation, and compliance requirements.

What is a Payroll Service Provider?

A payroll service company is an organization that manages payroll processes for other businesses. These companies handle a range of tasks, including wage calculations, tax withholdings, paycheck processing, and tax filings.A payroll company serves as a strategic partner for businesses, leveraging specialized knowledge, advanced technology, and economies of scale to offer expertise and efficiency that would be challenging and costly for many businesses to maintain in-house.

Payroll providers stay informed about changes in tax laws, labor regulations, and reporting requirements across different jurisdictions. This knowledge ensures their clients’ payroll processes remain compliant with all applicable laws and regulations, protecting businesses from potential fines and legal issues.

These companies typically offer cloud-based software solutions that integrate with other business systems. These platforms often include features for time tracking, benefits administration, reporting and analytics, and employee self-service portals. This integrated approach allows for comprehensive management of employee data and compensation.

Payroll Provider Responsibilities

Payroll solutions providers offer a comprehensive suite of services designed to manage all aspects of employee compensation and related compliance requirements.

Wage Calculations

This fundamental function involves computing regular wages, overtime, bonuses, and commissions based on employee work hours and pay rates. Payroll providers use payroll management software to handle complex calculations, including overtime pay, shift differentials, performance-based bonuses, retroactive pay adjustments, and paid time off accruals.

Tax Withholdings and Filings

Payroll providers calculate and withhold appropriate federal, state, and local taxes from employee paychecks. They also prepare and submit required payroll tax forms to relevant government agencies, including quarterly federal tax returns, annual federal unemployment tax returns, and state-specific tax forms. They manage tax deposits, ensuring timely payments to avoid penalties.

Paycheck Processing

Once all calculations are complete, payroll providers generate and distribute paychecks or process direct deposits for employees. This process includes creating detailed pay stubs, managing different pay frequencies, handling off-cycle or special payrolls, and providing year-to-date totals for easy reference.

Compliance Management

Payroll compliance management service providers ensure adherence to a wide range of regulations, including Fair Labor Standards Act (FLSA) requirements, state-specific labor laws, Affordable Care Act (ACA) reporting, and Equal Employment Opportunity Commission (EEOC) requirements. They stay updated on regulatory changes and adjust payroll processes accordingly.

Reporting and Analytics

Payroll providers generate detailed reports for accounting, budgeting, and audit purposes. These may include payroll summaries, tax liability reports, labor cost distribution reports, and custom reports tailored to the business’s specific needs.

Benefits Administration

Many payroll companies assist with managing employee benefits deductions and contributions, including health insurance premiums, retirement plan contributions, and flexible spending account (FSA) or health savings account (HSA) contributions.

Time and Attendance Tracking

Providers often offer systems for tracking employee work hours and leave, which integrate directly with the payroll software, reducing manual data entry and potential errors.

Employee Self-Service

Payroll providers offer portals for employees to access current and past pay stubs, view and download tax forms, update personal information, manage direct deposit details, and access benefits information.

Many payroll companies also assist with broader aspects of employee compensation, including designing salary structures, developing performance-based pay systems, managing equity compensation programs, and structuring comprehensive benefits packages.

During peak payroll periods, our clients’ financial departments can save up to 33% of their working time by outsourcing payroll to GEOR. This allows them to free up valuable time for more strategic tasks.

Benefits of Outsourcing to a Payroll Provider

Outsourcing to a payroll management company offers numerous advantages for businesses:

- Time Savings. Payroll business management by experts frees up internal resources, allowing staff to focus on core business activities and strategic initiatives. Payroll processing is time-consuming, often requiring hours of work each pay period. The time saved can be redirected to revenue-generating activities, allowing management to focus on business growth and development.

- Error Reduction. Experts in payroll use advanced systems and have extensive experience, significantly reducing the likelihood of costly payroll errors. Payroll errors can lead to employee dissatisfaction, decreased morale, and penalties from tax authorities. Accurate payroll ensures proper financial reporting and budgeting.

- Compliance Assurance. Payroll service providers stay up-to-date with changing regulations, ensuring businesses remain compliant with all relevant laws. Payroll regulations are complex and frequently changing. Non-compliance can result in hefty fines and legal issues. Staying compliant in-house requires constant vigilance and education.

- Cost-Effectiveness. Outsourcing often proves more economical than maintaining an in-house payroll department, especially for small to medium-sized businesses. It eliminates costs associated with payroll software and its maintenance, reduces staffing costs for payroll personnel, and avoids costs related to training and keeping staff updated on payroll regulations.

- Enhanced Security. Payroll service providers invest in robust security measures to protect sensitive employee data, often exceeding what individual businesses can implement. Payroll data is highly sensitive and a prime target for cybercriminals. Professional providers use advanced encryption and multi-factor authentication to safeguard data.

- Expertise Access. Businesses gain access to a team of payroll professionals with specialized knowledge and experience. These experts can provide guidance on complex payroll issues, offer insights on best practices and industry trends, and help optimize payroll processes for efficiency and compliance.

- Scalability. Payroll management companies can easily adapt their services as businesses grow or change, accommodating fluctuations in employee numbers or expansion into new markets. This eliminates the need to hire additional payroll staff during growth periods and allows for easy management of seasonal fluctuations in workforce.

- Technology Access. Providers offer access to advanced payroll software and tools that might be costly for individual businesses to purchase and maintain. Advanced software can automate many payroll tasks, increasing efficiency. Regular updates ensure the software remains compliant with changing regulations.

- Audit Support. In case of audits, payroll providers can offer valuable support and documentation. Payroll audits can be time-consuming and stressful. Professional providers maintain detailed records and can quickly provide required documentation, helping navigate the audit process more smoothly.

- Employee Satisfaction. Accurate and timely payroll processing contributes to employee satisfaction and trust in the company. Easy access to payroll information through self-service portals improves employee experience, and prompt resolution of payroll issues leads to higher employee satisfaction.

When a Business Needs to Turn to a Payroll Provider?

Several indicators suggest a business might benefit from turning to a payroll service provider:

Lack of In-House Expertise

When a company doesn’t have staff with specialized payroll knowledge, outsourcing becomes necessary. Small businesses may not have the resources to hire dedicated payroll professionals, and as companies grow, payroll becomes more complex, outpacing the skills of general admin staff.

Rapid Growth

When a business is expanding quickly, making payroll management increasingly complex, a provider becomes beneficial. Rapid hiring can overwhelm existing payroll processes, and expansion into new states or countries introduces new regulatory requirements.

Time Constraints

When management of payroll is consuming too much time that could be better spent on core business activities, outsourcing becomes attractive. As businesses grow, the time required for payroll management often increases disproportionately.

Cost Concerns

When the cost of maintaining an in-house payroll department exceeds the cost of outsourcing, a payroll service should be considered. In-house payroll requires investment in software, training, and dedicated staff. As businesses grow, these costs often escalate.

Multi-State or International Operations

When a business operates in multiple states or countries with varying tax laws and regulations, a payroll provider becomes invaluable. Each jurisdiction has its own payroll tax rates and filing requirements, making compliance exponentially more complex with each new location.

Technology Upgrade Needs

When the current payroll system is outdated, and upgrading in-house would be costly, outsourcing is often more efficient. Modern payroll systems require significant investment, and keeping software up-to-date with changing regulations can be challenging.

Data Security Concerns

When a business lacks resources to implement robust security measures for payroll data protection, outsourcing becomes a safer option. Payroll data is highly sensitive and a prime target for cybercriminals. Implementing and maintaining strong data security measures can be costly.

Strategic Focus

When company leadership wants to focus on strategic growth rather than administrative tasks, outsourcing payroll allows for this shift in focus. Payroll providers handle the complex administrative work, freeing up leadership to concentrate on core business strategies and growth initiatives.

Find out how simple payroll calculation can be for your business

Integrating Payroll with Other Business Processes

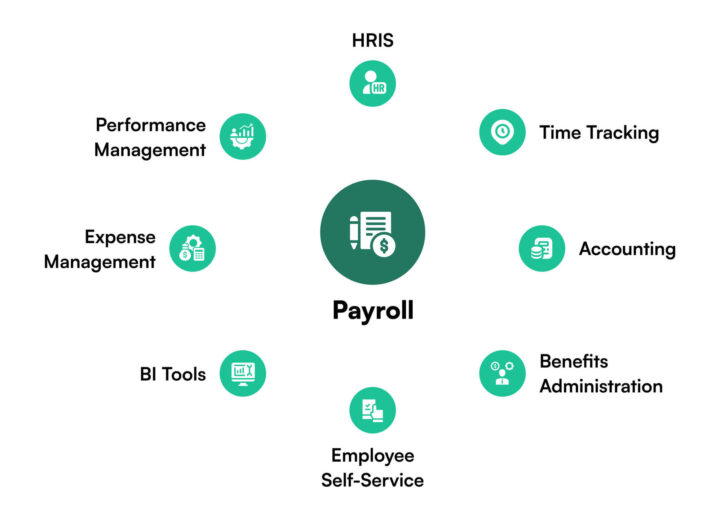

Payroll service providers offer robust integration capabilities with various business systems. This interconnectedness creates a seamless flow of data across different departments, enhancing efficiency and accuracy in payroll business management. Here’s a detailed look at key integration points.

Human Resources Information Systems (HRIS)

Integration between payroll and HRIS ensures consistency in employee data across all platforms. This connection streamlines processes such as onboarding and offboarding. When new employee information is entered in the HRIS, it automatically populates the payroll system, reducing duplicate data entry and potential errors. Similarly, when an employee leaves, updating the HRIS triggers appropriate changes in payroll, ensuring timely termination of payments and benefits.

Time and Attendance Tracking

Integrating payroll with time tracking software offers several advantages. Work hours, overtime, and leave data flow directly into the payroll system, eliminating manual data entry and reducing errors. This real-time update capability ensures that employees are paid accurately for their actual worked hours.

Accounting and Financial Management Systems

Connecting payroll with accounting software creates a more cohesive financial management process. Real-time payroll data helps in more accurate cash flow forecasting and budgeting, allowing businesses to better manage their financial resources.

Benefits Administration Platforms

Integration between payroll and benefits systems offers significant advantages in managing employee compensation packages. Benefit premiums and contributions are automatically calculated and deducted from employee paychecks, ensuring accuracy and timeliness. Changes in benefits elections immediately reflect in payroll deductions, maintaining consistency between an employee’s chosen benefits and their pay.

Performance Management Systems

Linking payroll with performance management tools facilitates more dynamic and responsive compensation strategies. Financial incentives tied to specific performance goals can be seamlessly incorporated into payroll, creating a more direct link between employee performance and compensation.

Expense Management Software

Integration with expense management systems streamlines reimbursement processes, enhancing efficiency and employee satisfaction. Proper categorization of reimbursements ensures correct tax treatment, reducing compliance risks and potential issues with tax authorities.

Business Intelligence (BI) Tools

Connecting payroll data with BI tools allows for deep insights into labor costs and trends. Business owners can access detailed breakdowns of labor costs by department, project, or location, enabling more informed decision-making.

Employee Self-Service Portals

Integration provides employees with a single access point for managing their employment-related information and tasks. Employees can access current and past pay stubs, W-2 forms, and year-to-date earnings information.

The integration of payroll with these various business systems offers significant benefits for business owners. It drastically reduces manual data entry, minimizing errors and saving time.

For business owners, this level of integration transforms payroll from a standalone administrative function into a key component of a comprehensive business management system. It provides the tools and insights necessary to optimize workforce management, control costs, and drive business growth. By leveraging these integrated systems, owners can spend less time on administrative tasks and more time focusing on strategic initiatives to advance their business.

Conclusion

Payroll providers play a crucial role in modern business operations. They offer expertise, efficiency, and peace of mind in managing one of the most critical and complex aspects of running a business.

By partnering with a payroll service provider GEOR, companies can ensure accurate and compliant payroll processing while freeing up resources to focus on growth and innovation. As businesses evolve and regulatory environments become more complex, the value of professional payroll services continues to grow.