Payroll management is critical for business success. This guide provides business owners with key information on payroll processes, legal requirements, and employee compensation management.

The Importance of Effective Payroll Management

Payroll management ensures accurate and timely employee compensation. It maintains compliance with tax laws and labor regulations, preventing legal issues and penalties. Proper payroll management provides financial data for decision-making, budgeting, and forecasting. It also contributes to employee satisfaction and retention.

Accurate and timely compensation is fundamental to payroll management. It involves calculating correct pay amounts, maintaining consistent payment schedules, and properly handling wages, overtime, bonuses, and commissions. Correct deduction management is crucial. These practices build employee trust and reduce pay-related inquiries and disputes.

Payroll management provides valuable financial insights. It offers data on labor costs across departments, helps identify trends in overtime usage and costs, and assists in budget planning and forecasting. This information supports decision-making on hiring and compensation, enables analysis of payroll expenses relative to revenue, and aids in determining the financial impact of business changes.

Payroll Management Methods

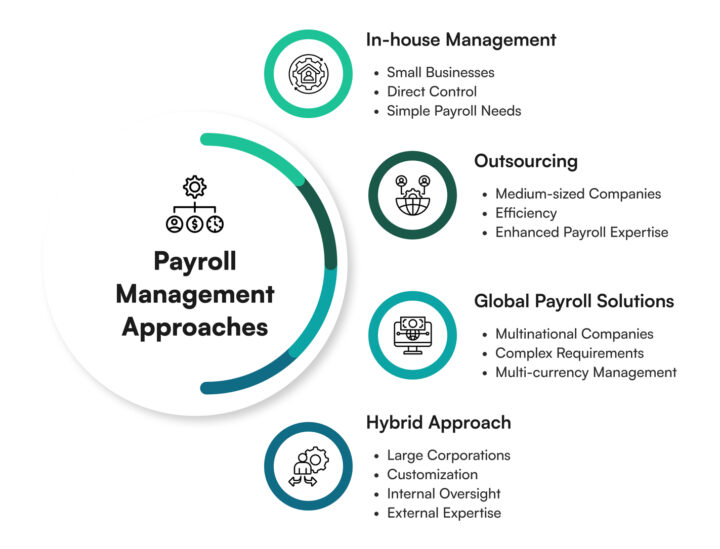

The choice of who manages payroll depends on various factors, including company size, budget, and payroll complexity.

In-house management is suitable for small businesses. It provides direct control over the payroll process but requires dedicated staff and up-to-date knowledge of tax laws. This approach can be cost-effective for companies with simple payroll needs.

Outsourcing to payroll management services is ideal for medium-sized companies. These outsourced solutions offer expertise and efficiency, allowing businesses to focus on core activities. They provide access to specialized knowledge and tools, which can be particularly beneficial as a company grows.

Large corporations often adopt a hybrid approach, combining in-house staff with payroll software. This offers customization and control while leveraging the benefits of automation. It allows for a balance between internal oversight and external expertise.

For multinational companies, a global payroll solution is essential. These specialized services handle complex international payroll requirements, navigate different tax systems and regulations, and manage multi-currency payroll and compliance issues. GEOR provides global payroll services. If you have any difficulties with payroll, we will help you set up the process and take care of all the difficulties.

Let GEOR handle all tax filings and payments

What is a Payroll System?

A payroll system is a comprehensive set of processes and tools used by businesses to manage employee compensation. It handles salary calculations, tax withholdings, deductions, and payment distribution.

Tax management is a critical aspect of payroll systems. It calculates federal, state, and local taxes, handles tax withholdings, and generates necessary tax forms such as W-2s and 1099s. Deductions processing manages health insurance premiums, handles retirement contributions, and processes garnishments and other deductions.

When choosing a payroll system, several factors should be considered:

- The system’s capabilities should match the company’s size and needs. Budget considerations include both initial and ongoing costs.

- Integration capabilities with existing HR and accounting systems are important for seamless operations.

- Scalability ensures the system can grow with the business. Availability of customer service and technical support is crucial for smooth operations.

- The system should have robust compliance features to handle local, state, and federal regulations.

- Reporting capabilities, including the depth and customization of financial reports, are also important considerations.

A payroll system is a crucial tool for efficient business operations. It streamlines compensation management, ensures compliance, and provides valuable financial insights. The choice and implementation of a payroll system can significantly impact operational efficiency and employee satisfaction, making it a vital consideration for businesses of all sizes.

If you need to choose a payroll system, GEOR experts can help you find the right option for your business.

Criteria for Implementing Payroll Management Software

Selecting the right time to implement payroll management software is crucial for business efficiency and growth. This section outlines key indicators that suggest when a business should consider adopting or upgrading its payroll software solution.

- Business growth. Consider implementing payroll management software when your business is growing. As employee count increases and payroll needs become more complex, software can help manage the increased workload efficiently.

- Time-consuming manual processes. If manual processes become time-consuming or error-prone, it’s time to consider automation. Software can significantly reduce the time spent on payroll tasks and minimize errors.

- Need for improved accuracy and compliance. When better accuracy and compliance are needed, payroll software can be a solution. These systems can help stay updated with changing tax laws and reduce human errors in calculations.

- Streamlining operations. If you want to streamline operations, automating repetitive tasks can significantly improve overall efficiency. This allows staff to focus on more strategic aspects of the business.

- Advanced reporting requirements. When advanced reporting capabilities are required, payroll software can provide detailed financial reports and customizable analytics. This data can offer valuable insights for business decision-making.

- International expansion. For businesses expanding internationally, software with international payroll management capabilities becomes crucial. These systems can handle multi-currency payroll, comply with various international regulations, and manage the complexities of global workforce compensation.

Implementing payroll management software is a significant decision that can greatly impact business efficiency and compliance. By recognizing these key indicators, businesses can time their transition to automated payroll systems effectively, ensuring they reap the maximum benefits of such technology while supporting their growth and operational needs.

By outsourcing their payroll to us, our clients were able to reduce their workload in the financial department by 33% during peak periods.

Advantages of Payroll Management Software

Payroll management software streamlines and automates the payroll process, offering significant advantages for businesses. It reduces manual errors, saving time and money on correcting mistakes. The software ensures compliance with tax laws and regulations, minimizing the risk of penalties. It provides accurate and timely payments to employees, improving satisfaction and retention. Payroll software generates detailed reports, offering insights into labor costs and helping with budget planning. It integrates with other business systems, such as accounting and HR, for seamless data flow. The software also enhances data security, protecting sensitive employee information. Overall, it increases efficiency, allowing staff to focus on strategic tasks rather than administrative work.

Main Types of Payroll Management Software

There are several types of payroll management software tailored to different business needs:

- On-premises software. Installed and operated on the company’s own computers and servers. It offers full control over data but requires IT infrastructure and maintenance.

- Cloud-based software. Accessed via the internet, requiring no installation. It provides flexibility, automatic updates, and lower upfront costs.

- Enterprise Resource Planning (ERP) modules. Part of larger ERP systems, offering integrated payroll management with other business functions.

- Small business-focused software. Simplified solutions with essential features for small to medium-sized businesses.

- Industry-specific software. Tailored for particular sectors like healthcare or construction, addressing unique payroll requirements.

- Modular systems. Allow businesses to add or remove features as needed, providing scalability.

- All-in-one HR suites. Combine payroll with other HR functions like time tracking, benefits administration, and performance management.

Each type offers distinct features and pricing models, catering to various business sizes, industries, and complexities of payroll needs.

Optimizing Payroll Software Usage

Selecting the right payroll software is crucial for businesses of all sizes. The best payroll software streamlines operations, ensures compliance, and saves time and resources.

- Choose user-friendly software. Choose software with intuitive interfaces and comprehensive features that meet your specific needs. Consider scalability for future growth and evaluate customer support and training options.

- Ensure data security. Implement strong encryption and use robust access controls to protect sensitive payroll information. Conduct regular security audits and updates to maintain data integrity.

- Integrate with other business systems. Integrate payroll software with accounting and HR platforms for seamless data flow. This integration reduces data entry errors and improves overall efficiency.

- Regularly update the software. Stay informed about software updates and plan for their implementation. Regular updates provide security patches and new features while minimizing disruption to payroll processes.

- Provide thorough staff training. Offer initial and ongoing training to ensure proper use of all features. This investment in training can significantly reduce errors and improve efficiency.

- Utilize automated features. Take advantage of features like scheduled payments and automatic tax calculations. These features streamline payroll processes and reduce manual workload.

- Implement robust backup systems. Use cloud storage and off-site backups to protect against data loss. Conduct regular backups and test restoration procedures to ensure business continuity.

The best payroll software for your business will depend on your specific needs, budget, and growth trajectory. It’s advisable to take advantage of free trials when available to ensure the software meets your company’s requirements before making a long-term commitment.

Conclusion

Effective payroll management is fundamental to successful business operations. Whether choosing in-house management, outsourced services, or software solutions, prioritizing accuracy, compliance, and efficiency is key. For businesses with a global presence, a robust global payroll solution is essential to navigate international complexities. By implementing the right strategies and tools, businesses can ensure smooth payroll operations, maintain employee satisfaction, and support sound financial management.