Effective compensation management is a critical component of business success, directly impacting employee recruitment, retention, motivation, and overall organizational performance.

A well-structured compensation system can be a powerful tool for attracting top talent, driving employee performance, and aligning workforce efforts with company objectives.

What is Compensation Management?

Compensation management is the strategic process of designing and implementing an organization’s total rewards system. This system encompasses all forms of financial and non-financial rewards provided to employees in exchange for their work. It includes base salaries, bonuses, benefits, stock options, and other perks.

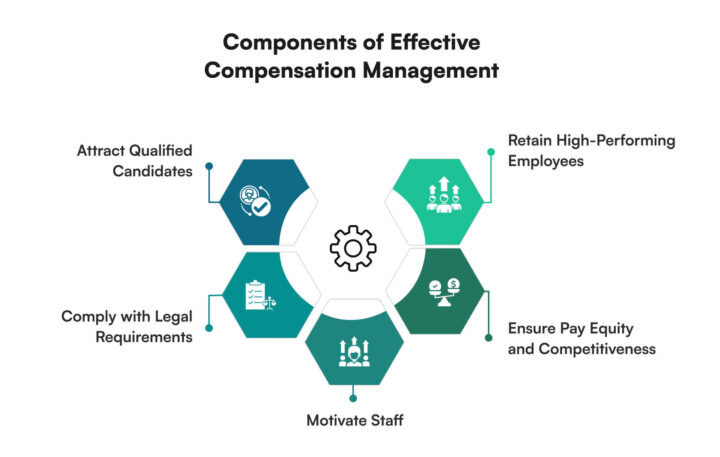

The primary objectives of compensation management are:

- Attract qualified candidates. A well-structured compensation package serves as a powerful tool to draw top talent to the organization. It includes competitive salaries, benefits, and other incentives that appeal to potential employees in the job market.

- Retain high-performing employees. Effective compensation management helps keep valuable employees within the organization. By offering competitive and fair compensation, companies reduce the risk of losing skilled workers to competitors.

- Motivate staff to achieve organizational goals. Compensation structures can be designed to incentivize specific behaviors and outcomes. This includes performance-based bonuses, profit-sharing plans, or other variable pay components that encourage employees to meet or exceed targets.

- Ensure internal pay equity and external competitiveness. A well-managed compensation system maintains fairness within the organization by ensuring that similar roles are compensated equitably. It also keeps the company competitive in the external job market by offering salaries and benefits that are in line with or exceed industry standards.

- Comply with legal requirements and industry standards. Compensation management ensures that the organization adheres to all relevant labor laws, minimum wage requirements, overtime regulations, and industry-specific compensation norms.

Effective compensation management requires a balance between employee expectations, market rates, and the organization’s financial capabilities. It involves regular market analysis, job evaluations, and performance assessments to ensure the compensation strategy remains relevant and competitive.

Compensation Management vs. Payroll: Key Differences

Compensation management and payroll are two distinct yet interconnected aspects of employee remuneration. While both deal with employee payments, they serve different purposes and involve different processes within an organization.

Compensation management is a strategic function that involves designing, implementing, and continually refining an organization’s overall compensation structure. It encompasses determining salary ranges, creating bonus and incentive plans, and developing benefit packages. The goal of compensation management is to attract, retain, and motivate employees while aligning their performance with organizational objectives.

Payroll, on the other hand, is an operational function focused on the actual execution of employee payments. It involves calculating wages, processing deductions, and ensuring timely disbursement of salaries. Payroll management is primarily concerned with accuracy, compliance with tax laws, and efficient payment processing.

Our clients have seen a 26% increase in employee loyalty to their company and a 12% increase in retention! This is a great sign that compensation is having a positive impact on employee incentives.

Key differences between compensation management and payroll include:

- Scope. Compensation management covers the entire reward strategy, while payroll deals specifically with wage calculations and payments.

- Timeframe. Compensation management is a long-term, strategic process, whereas payroll operates on a regular, often monthly or bi-weekly, cycle.

- Decision-making level. Compensation strategies are typically set by senior management and HR leaders, while payroll is usually managed by finance or dedicated payroll professionals.

- Skills required. Compensation management requires strategic thinking, market analysis, and an understanding of motivational psychology. Payroll management requires attention to detail, knowledge of tax regulations, and proficiency in payroll software.

- Impact on business strategy. Compensation management directly influences talent acquisition, retention, and overall business strategy. Payroll, while crucial for employee satisfaction, has a more indirect impact on strategic goals.

Here’s a table summarizing the key differences:

| Aspect | Compensation Management | Payroll |

|---|---|---|

| Primary Focus | Strategic planning of total rewards to attract, retain, and motivate employees. This involves creating a comprehensive framework that balances base pay, variable compensation, benefits, and non-monetary rewards to meet both employee needs and organizational objectives. | Accurate and timely processing of employee payments and deductions. This involves calculating wages, managing deductions, and ensuring employees receive correct payments according to established schedules. |

| Timeframe | Long-term strategic planning, typically annual or multi-year. Compensation strategies are developed to align with the company's long-term business goals and are regularly reviewed and adjusted to remain competitive and effective. | Short-term operational cycles (weekly, bi-weekly, or monthly). Payroll operates on a regular, recurring basis to process payments in accordance with the company's pay periods. |

| Key Activities | Designing salary structures, creating bonus and incentive plans, developing benefit packages, conducting market salary surveys, analyzing internal pay equity. | Calculating regular and overtime wages, processing tax withholdings, managing benefit deductions, issuing payments to employees, and generating payroll reports. |

| Decision Makers | C-level executives set overall compensation philosophy. HR directors develop and implement strategies. Compensation specialists provide expertise in job evaluation and market analysis. | Payroll managers oversee operations and ensure accuracy. Finance team members manage budgets and reconciliations. HR administrators handle employee inquiries and data updates. |

| Required Skills | Strategic thinking, market analysis, financial modeling, understanding of motivational psychology, and knowledge of labor laws. | Attention to detail, knowledge of tax regulations, proficiency in payroll software, data entry accuracy, and time management. |

| Business Impact | Influences talent acquisition and retention, affects employee motivation and performance, and impacts overall labor costs and budgeting. | Ensures employee satisfaction through accurate payments, maintains legal compliance, and affects cash flow management. |

| Software Used | Compensation planning tools, salary survey databases, and performance management systems. | Payroll processing systems, time and attendance software, and tax filing tools. |

| Compliance Focus | Equal pay regulations, industry-specific compensation standards, and corporate governance requirements. | Tax laws (federal, state, local), labor regulations, and benefit-related compliance. |

| Reporting | Compensation budget forecasts, pay equity analyses, and total rewards statements. | Payroll registers, tax remittance reports, and year-end tax forms. |

| Stakeholder Engagement | Involves board of directors in approving major changes. Requires employee communication on compensation philosophy. | Primarily an internal process with direct interaction for employee payroll queries. |

Advantages and Challenges in Compensation Management

Compensation management offers numerous benefits to organizations but also presents several challenges. Understanding these can help businesses develop more effective compensation strategies and anticipate potential issues.

Benefits of Compensation Management

The benefits of effective compensation management are far-reaching. They contribute to a company’s ability to attract and retain top talent, drive performance, ensure fairness, and align employee efforts with organizational goals.

The most important advantages include:

- Attracts top talent. A well-designed compensation package can give an organization a competitive edge in recruiting skilled professionals.

- Improves employee retention. Fair and competitive compensation reduces turnover, saving recruitment and training costs.

- Boosts motivation and productivity. Performance-based compensation encourages employees to meet or exceed targets.

- Ensures fair and equitable pay practices. Structured compensation management helps eliminate pay disparities based on gender, race, or other non-job-related factors.

- Aligns employee performance with organizational goals. Properly designed incentive plans can drive behaviors that support company objectives.

By recognizing and leveraging these benefits, businesses can create a more engaged, productive, and loyal workforce, ultimately contributing to the organization’s overall success and competitiveness in the market.

Challenges of Compensation Management

While compensation management offers significant benefits, it also presents several challenges that businesses must navigate. These challenges require careful consideration and strategic planning to overcome.

Some of the main challenges include:

- Balancing competitive pay with budget constraints. Organizations must offer attractive compensation while maintaining financial stability.

- Keeping up with changing market rates. Regular market research is necessary to ensure compensation remains competitive.

- Ensuring compliance with labor laws and regulations. Compensation practices must adhere to minimum wage laws, overtime regulations, and anti-discrimination statutes.

- Managing employee expectations. Clear communication about compensation policies and decisions is crucial to maintain employee satisfaction.

- Addressing pay equity issues. Identifying and rectifying pay disparities requires ongoing analysis and adjustment.

Recognizing and addressing these issues is crucial for implementing an effective compensation system that meets both organizational and employee needs.

Main Components of Compensation Packages

Compensation comes in various forms, each serving different purposes in attracting, retaining, and motivating employees. Understanding the main types of compensation allows businesses to create comprehensive and attractive packages that meet diverse employee needs and organizational objectives.

- Base salary. Fixed amount paid regularly (weekly, bi-weekly, or monthly) for standard job duties.

- Variable pay. Performance-based compensation such as bonuses, commissions, or profit-sharing. This type of pay is tied to individual, team, or company performance.

- Benefits. Non-wage compensation including health insurance, retirement plans, paid time off, and other perks. Benefits can significantly enhance the overall value of an employee’s compensation package.

- Equity compensation. Stock options, restricted stock units (RSUs), or other forms of company ownership offered to employees. This type of compensation aligns employee interests with company performance and can be a powerful retention tool.

- Non-monetary compensation. Includes flexible work arrangements, professional development opportunities, recognition programs, and other intangible rewards that contribute to job satisfaction and work-life balance.

Each type of compensation plays a unique role in the overall reward strategy of an organization. By effectively combining these different elements, businesses can create comprehensive compensation packages that attract top talent, motivate performance, and align employee interests with company goals. The right mix of compensation types can significantly enhance an organization’s ability to compete in the labor market and drive business success.

SMBs should have a compensation strategy to compete with tech giants for tech talent. Investing $100 will save up to $500 on retention and new hires.

The Strategic Role of Compensation in Human Resources

Compensation is a critical component of human resource management. It directly impacts numerous aspects of an organization’s workforce and overall business performance. Understanding the importance of compensation to HR helps business owners and managers appreciate its strategic role in achieving organizational objectives.

Compensation is a critical aspect of human resources management for several reasons:

- Talent acquisition and retention. Competitive compensation packages help attract qualified candidates and retain valuable employees, reducing turnover costs.

- Employee engagement and satisfaction. Fair and transparent compensation practices contribute to higher job satisfaction and increased employee engagement.

- Organizational culture and values. Compensation strategies reflect and reinforce company culture, demonstrating what the organization values in its employees.

- Legal compliance and risk management. Proper compensation management ensures adherence to labor laws and regulations, minimizing legal risks and potential penalties.

- Budget allocation and financial planning. Compensation typically represents a significant portion of an organization’s expenses, making it crucial for financial planning and resource allocation.

Effective compensation reward management allows HR professionals to create a competitive advantage in the labor market and support overall business objectives. It requires a deep understanding of industry trends, labor laws, and the organization’s strategic goals.

Compensation Management in Different Countries

International compensation management requires a nuanced approach due to diverse economic, cultural, and legal landscapes across countries. Multinational companies must navigate a complex web of local labor laws, cost of living variations, currency fluctuations, tax implications, and cultural expectations regarding compensation.

To address these challenges, global organizations often adopt a hybrid strategy, combining overarching global policies with localized approaches. This may include developing a universal compensation philosophy aligned with the company’s overall strategy, while implementing region-specific compensation structures. Companies also utilize local market data to ensure competitiveness, implement global job grading systems for internal equity, and offer flexible benefits tailored to local preferences.

Here’s a comparison of key compensation factors across select countries:

| Country | Minimum Wage (USD/hour) | Avg. Annual Salary (USD) | Paid Leave (days/year) | Pension Contribution (% of salary) |

|---|---|---|---|---|

| USA | 7.25 | 69,392 | 10 | 6.2% (Social Security) |

| UK | 12.14 | 47,325 | 28 | 5% (workplace pension) |

| Germany | 12.0 | 56,74 | 20 | 9.3% (statutory pension) |

| Japan | 7.94 | 39,000 | 10 | 9.15% (pension insurance) |

| Australia | 14.54 | 63,000 | 20 | 10.5% (superannuation) |

| India | 0.28 | 5,200 | 12 | 12% (provident fund) |

Submit a request so we can develop a customized

solution for you

Outsourcing Compensation Management

Many organizations choose to outsource some or all of their compensation management functions. This approach offers several advantages. Compensation consultants and outsourcing providers often have deep knowledge of market trends, best practices, and regulatory requirements, providing access to specialized expertise. Outsourcing routine tasks like data entry, report generation, and benefits administration frees up internal resources for strategic activities, reducing the administrative burden. Specialized providers stay up-to-date with changing regulations, helping to ensure the organization remains compliant, thus improving compliance management.

Outsourcing can be more cost-effective than maintaining in-house systems and dedicated staff, especially for smaller organizations, leading to cost savings on technology and staffing. External providers can offer unbiased insights and recommendations, helping to address sensitive issues like pay equity, providing an objective third-party perspective.

Workers compensation solutions are often included in outsourced compensation services, helping companies manage complex insurance and claims processes. These services can encompass policy administration and renewal, claims management and reporting, risk assessment and loss prevention strategies, and compliance with state-specific workers’ compensation regulations.

When considering outsourcing compensation management, organizations should carefully evaluate potential providers based on their expertise, technology capabilities, and alignment with the company’s culture and goals. This evaluation ensures that the chosen provider can effectively meet the organization’s specific compensation management needs while integrating seamlessly with existing processes and values.

What is Compensation Management Software?

Compensation management software is a specialized tool designed to automate and streamline the process of planning, administering, and analyzing employee compensation. These systems often integrate with other HR and payroll platforms to provide a comprehensive compensation solution.

Key features of compensation management software include:

- Salary structure management. Tools for creating and maintaining pay grades, salary ranges, and job classifications.

- Budget planning and forecasting. Capabilities for modeling different compensation scenarios and their financial impacts.

- Performance-based pay calculations. Automated systems for calculating bonuses, commissions, and other variable pay based on predefined criteria.

- Equity analysis and reporting. Tools for assessing pay equity across different employee groups and generating reports for compliance and decision-making.

- Compliance tracking and documentation. Features to ensure compensation practices adhere to relevant laws and regulations, with proper documentation for audits.

Compensation management software helps organizations optimize their compensation resources management by providing data-driven insights, reducing manual errors, and ensuring consistency across the workforce. It enables HR professionals and managers to make informed decisions about compensation and communicate these decisions effectively to employees.

Conclusion

Effective compensation management is a critical factor in organizational success. It requires a strategic approach that balances employee needs, market conditions, and business objectives.

By leveraging compensation management software and considering outsourcing options, companies can optimize their compensation programs and gain a competitive edge in attracting and retaining top talent. The investment in effective compensation management can yield significant returns in terms of employee performance, satisfaction, and overall organizational success.

GEOR offers compensation management solutions for businesses of all sizes. We take care of all your compensation management needs.